Contents:

In this Education loan EMI calculator, we have taken that into consideration. Amortization refers to the process that spreads out a loan into a series of payments made at fixed intervals. Thus the loan is finally paid off at the completion of the payment schedule.

Mortgage Amortization Calculator – Forbes Advisor – Forbes

Mortgage Amortization Calculator – Forbes Advisor.

Posted: Tue, 08 Nov 2022 08:00:00 GMT [source]

When the interest rates are on a downward slope then old/existing borrowers are locked at higher interest rate. A bank may demand conversion fees to increase the spread on BPLR / RPLR or reduce markup on base rate. Before you accept any such offer, it is important to know interest rate offered to new borrowers. You should not agree to anything less than interest rate offered to new borrowers.

Are you Bank of Baroda Customer?

For example, if you loan amortization schedule calculator india a loan of Rs.5 lakh at an interest rate of 12% for a tenure of 48 months, then the formula will be (500000x48x0.01). Here 0.01 will be the rate of interest will be 12% divided by 12 which will yield 0.01%. On using the formula, the result yielded will be the EMI payable. The restructuring window will be available till 31st December 2020.

For example, if you discontinue banking with your present bank and move to another bank, you will have to issue new EMI instructions. Also, in case if there is any change in your EMI due to a revision of interest rate, the bank might request you to submit fresh instructions. You may enter the month, loan amount, interest rate and installment amount in cell no B12, C12, D12, and F12 respectively. For the benefit of readers, i am explaining how to use this EMI Calculator.

What is a home loan amortisation schedule?

Secondly, you need to check the interest rate offered by the market leaders. There is a possibility that after payment of conversion fees, your bank is offering the interest rate same as offered to the new borrowers. At the same time, it might be higher than the interest rates offered by market leaders. SBI Flexipay Home loan provides an eligibility for a greater loan. It offers customer the flexibility to pay only interest during initial 3-5 years and thereafter in flexible EMIs.

How do I calculate loan amortization in Excel?

- Create column A labels.

- Enter loan information in column B.

- Calculate payments in cell B4.

- Create column headers inside row seven.

- Fill in the ‘Period’ column.

- Fill in cells B8 to H8.

- Fill in cells B9 to H9.

- Fill out the rest of the schedule using the crosshairs.

For the loans taken from 16th to 31st, the EMI is deducted on the 5th of next to next month. The documentation process is easy and you can get a loan against property from any bank in India. You can choose from different types of interest rates and payment options such as floating rates or fixed interest rates.

The loan against property EMIs are made up of both, the principal and the interest portions. The pledged asset remains as collateral with the lender until you repay the total loan against the property amount. The loan against property interest rates is lower as compared to an unsecured loan such as a personal loan. The loan against property has no end-use restrictions, and you may use the loan for individual needs. The loan against property is also called the mortgage loan as it is secured against immovable property.

The EMI comprises a portion of the principal amount loaned to purchase the property and a portion of the interest component payable against the loaned amount. Simply put, an amortization schedule is the road map towards the repayment of your home loan denoting the milestones and the ideal points you should be at through the cycle. Home loan interest rates with further options for you to choose between fixed or floating rates throughout the loan tenure. However, interest paid on the unpaid principal amount remains the same as banks calculate interest on reducing balance basis.

Privilege / Shaurya Home Loan Calculator

Some EMI calculators for home loan also provide a detailed breakup of the interest and principal amount you will be paying over the entire loan tenure. An EMI calculator is useful in planning your cash flows much in advance, so that you make your home loan payments with ease whenever you avail a home loan. In other words, an EMI calculator is a useful tool for your financial planning and loan servicing needs. HDFC also offers a facility of a pre-approved home loan even before you have identified your dream home. Apre-approved home loanis an in-principal approval for a loan given on the basis of your income, creditworthiness and financial position.

How To Calculate Loan EMI – Forbes Advisor INDIA – Forbes

How To Calculate Loan EMI – Forbes Advisor INDIA.

Posted: Tue, 01 Nov 2022 07:00:00 GMT [source]

This will help the borrower gain more time to repay their loan. The loan account will not be deemed as a non-performing asset and the credit score of the borrower will not have any negative impact. However, borrowers who have been paying their EMIs regularly and were not overdue by more than 30 days as of 1st March, 2020 are eligible to avail the personal loan restructuring facility.

What is Loan Against Property EMI?

EMI’s or Equated Monthly instalments are a systematized and comfortable approach to repaying loans availed. The amount repayable (amount borrowed + amount payable towards interest) is divided throughout the tenor of the loan with uniform amounts payable per month. Buying a house is a financial goal and to accomplish it, a home loan can come to your aid. With an Equated Monthly Instalment facility, repayments become comfortable.

However, as the loan is secured against collateral , the bank may sanction the loan even for a lower credit score. LAP EMI calculator needs three key inputs to work, namely loan amount, tenor, andloan against property interest rates. Getting an education loan is an easy way to finance your dreams. A student loan can help you get into the university of your choice.

How is EMI schedule calculated?

How is EMI calculated? The mathematical formula to calculate EMI is: EMI = P × r × (1 + r)n/((1 + r)n – 1) where P= Loan amount, r= interest rate, n=tenure in number of months.

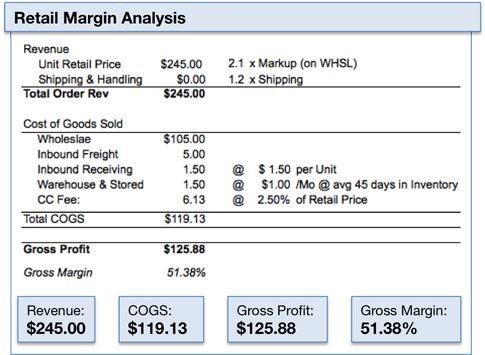

A pie chart depicting the break-up of total payment (i.e., total principal vs. total interest payable) is also displayed. It displays the percentage of total interest versus principal amount in the sum total of all payments made against the loan. The payment schedule table showing payments made every month / year for the entire loan duration is displayed along with a chart showing interest and principal components paid each year. A portion of each payment is for the interest while the remaining amount is applied towards the principal balance. During initial loan period, a large portion of each payment is devoted to interest.

What is Home Loan Amortization Schedule?

Customization options pertaining to the grace period, partial disbursal, repayment schedules are not allowed at all. It also the gives a graphic representation of the loan paid in Rupees as against years elapsed in terms of the total interest and the total amount paid. The BOB education loan EMI calculator also acts as an APR calculator. Like the others, the BOB Education Loan EMI calculator is also inflexible and has no options for customization. The Avanse Education Loan EMI calculator does have a few customization options pertaining to repayment – extra payout, larger EMIs and decreased tenures. All you need to do is enter the annual rate of interest in percentage, loan tenure in years, and education loan amount in Rupees into the online Auxilo education loan EMI calculator to calculate your EMI.

How do you calculate loan amortization schedule?

How to Calculate Amortization of Loans. You'll need to divide your annual interest rate by 12. For example, if your annual interest rate is 3%, then your monthly interest rate will be 0.25% (0.03 annual interest rate ÷ 12 months). You'll also multiply the number of years in your loan term by 12.

With each successive payment, you will pay more towards the principal and less in interest. Please note that the Home Loan EMI calculator has been created to give you an approximate understanding and should not be considered as absolute. The level of customization offered by GyanDhan’s education loan EMI Calculator is unprecedented as it provides you with the opportunity to factor in your grace period, flexible disbursals, processing fees. It also proposes various types of EMI based on full interest, partial interest, and full EMI. As an added benefit, you can also view and even download the complete loan repayment schedule, which will help you to plan your finances in a more organized and systematic manner.

GyanDhan’s education loan EMI calculator is an online tool that helps students calculate the amount they need to pay monthly after taking an education loan. It also gives you an amortization schedule which shows EMI break-up in terms of monthly interest paid and the principal repaid. And that’s not all, it also details the amount of loan that you have repaid till date and how much is outstanding.

- The user must just simply enter the new Outstanding Loan Amount in the Loan Amount column along with the pending number of months in the Tenure.

- For further details or to begin availing your loan, simply click on the “Get a call back” button and fill in your details.

- Providing end-to-end education loan assistance, GyanDhan is a digital-first company that seeks to revolutionize education financing in India.

- EMI itself is a complex subject and has a major impact on your financials.

- This online education loan EMI calculator has been developed by the financial team of WeMakeScholars to help such applicants plan their education loan repayment schedule in a systematic manner.

- EMI refers to the ‘Equated Monthly Installment’ which is the amount you will pay to us on a specific date each month till the loan is repaid in full.

Please note Brokerage would not exceed the SEBI prescribed limit. An instant reckoner for EMI amount based on inputs like Loan amount required, tenure of the loan and rate of interest . By clicking on the hyper-link, you will be leaving and entering website operated by other parties.

Choose a higher down https://1investing.in/- A higher downpayment gives you a lesser principal amount on which the EMI is calculated. Accurate- The home loan interest calculator helps you find out the exact amount of interest. CAs, experts and businesses can get GST ready with ClearTax GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. ClearTax can also help you in getting your business registered for Goods & Services Tax Law.

Also, remember to refer the amortization table for a year-wise plan of repayments throughout the loan tenure. You can also plan the payment in such a way that you do not miss any EMI payments which can also help in the bank reducing the overall interest rate in future. You can choose to make partial prepayment instead of foreclosing the loan. Partial prepayment reduces the principal amount remaining, thus reducing the interest part of the EMIs. However, you need to pay off a substantial amount of the loan for this method to be effective. Also, it is better to do so as early on in the loan period as possible.

Can I make my own amortization schedule?

You can build your own amortization schedule and include an extra payment each year to see how much that will affect the amount of time it takes to pay off the loan and lower the interest charges.

Comentários